Trusted Moving Solutions

Your reliable partner for seamless relocation.

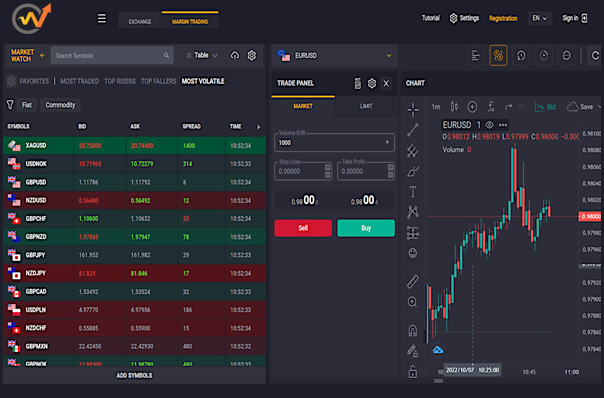

Trading Currency Chaos: Finding Order in the Forex Frenzy

Unravel the chaos of currency trading! Discover strategies to find order and profit in the Forex frenzy with expert insights and tips.

Understanding Currency Fluctuations: What Drives Forex Prices?

Understanding currency fluctuations is essential for anyone involved in foreign exchange (Forex) trading, as several factors influence the prices of currencies. One of the significant drivers of Forex prices is economic indicators, such as GDP growth, unemployment rates, and inflation. These indicators provide insights into a country's economic performance and stability, which can affect investor confidence and currency demand. Additionally, monetary policy decisions made by central banks also play a crucial role in shaping Forex prices. When a central bank changes interest rates or engages in quantitative easing, it can lead to significant shifts in currency valuation.

Another essential factor that drives Forex prices is geopolitical events and market sentiment. Events such as elections, political instability, or trade agreements can create uncertainty, leading to increased volatility in currency values. As market participants respond to these events, currencies may experience abrupt fluctuations. Additionally, technical analysis practices, where traders analyze price charts and patterns, can further influence currency prices as traders make decisions based on their interpretations of historical data.

Top 5 Trading Strategies to Navigate the Forex Market's Ups and Downs

The Forex market is known for its volatility, making it essential for traders to implement effective strategies to navigate its ups and downs. Here are the top 5 trading strategies that can help you stay ahead in this dynamic environment:

- Swing Trading: This strategy involves holding trades for several days to capitalize on expected price moves, ideal for those who cannot monitor the market constantly. Learn more about swing trading.

- Day Trading: Focus on short-term price movements by entering and exiting trades within the same day, requiring quick decision-making skills. For a deeper dive, check out this guide on day trading.

- Scalping: This involves making numerous trades over short periods to take advantage of minor price changes. It requires strict discipline and a good understanding of the market.

- Trend Following: By analyzing market trends, traders can make informed decisions about when to enter and exit trades. For in-depth knowledge, visit this resource on trend following.

- Carry Trade: This strategy takes advantage of interest rate differentials between currencies, potentially offering higher returns. Read more on carry trading here.

The Psychology of Forex Trading: How Emotions Impact Your Decisions

The world of Forex trading is not just dictated by charts and technical indicators; it is equally influenced by the trader's psychology. Emotions such as fear, greed, and excitement play crucial roles in how decisions are made. Fear, for instance, often leads traders to exit positions prematurely, while greed can cause them to hold onto losing trades in the hope of a turnaround. Recognizing and controlling these emotions can significantly enhance a trader's performance in the volatile Forex market. Research has shown that emotional regulation practices, such as journaling and mindfulness, can lead to better trading outcomes. To delve deeper into this subject, you can check out the findings from Investopedia.

Another critical aspect of the psychology of Forex trading is the concept of cognitive biases. Traders often succumb to biases such as overconfidence, confirmation bias, and loss aversion, which can cloud their judgment and lead to irrational trading decisions. Overconfidence might lead a trader to take excessive risks after a few wins, while confirmation bias may prevent them from acknowledging evidence that contradicts their existing beliefs. To mitigate these biases, traders can implement systematic trading plans and adhere to strict risk management strategies. For a more comprehensive analysis of these biases, consider visiting Forex.com.