Trusted Moving Solutions

Your reliable partner for seamless relocation.

Baffled by Insurance? Here's Your Friendly Policy Decoder

Unravel the mysteries of insurance! Join us for simple insights and tips to decode your policy with ease and confidence.

Understanding the Basics: What You Need to Know About Insurance Policies

Understanding the Basics: Insurance policies are contracts designed to protect you from financial losses. They provide coverage for various risks, such as health issues, property damage, and liability claims. Familiarizing yourself with the different types of insurance can be overwhelming at first. However, it's essential to break down the primary categories. Common types of insurance includes:

- Health Insurance

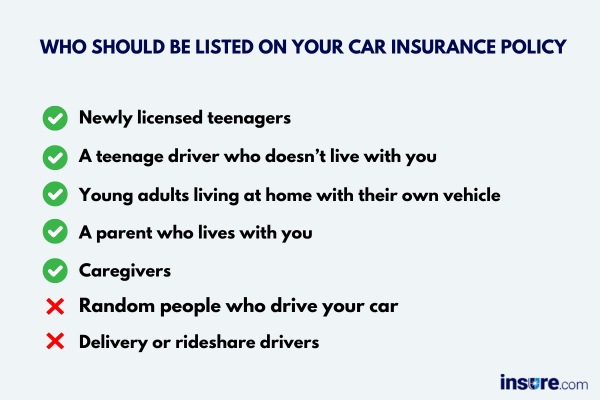

- Auto Insurance

- Homeowners Insurance

- Life Insurance

When selecting an insurance policy, it's vital to understand key terms such as premium, deductible, and coverage limit. The premium is the amount you pay for your policy, while the deductible is the out-of-pocket expense before your insurance kicks in. Coverage limits define the maximum amount your insurer will pay for a claim. Always read the fine print and consider speaking with an insurance agent to clarify any uncertainties. For more detailed explanations, check out Investopedia.

Common Insurance Terms Explained: Your Guide to Jargon-Free Coverage

Understanding the world of insurance can often feel overwhelming due to the multitude of terms and jargon used by industry professionals. This guide aims to demystify some of the common insurance terms you may encounter, helping you make informed decisions about your coverage. To start, let's explore key concepts such as premium and deductible. A premium is the amount you pay for your insurance policy, while a deductible is the amount you’ll need to pay out of pocket before your insurance kicks in. Knowing these terms can help you better understand your financial responsibilities when selecting a policy.

In addition to premium and deductible, it’s crucial to familiarize yourself with terms like coverage and exclusions. Coverage refers to the specific protections included in your insurance policy, while exclusions are situations or circumstances that are not covered by your insurance. Understanding these definitions ensures there are no surprises when you file a claim or renew your policy. For a deeper dive into the language of insurance, consider consulting resources like the Insurance Information Institute for comprehensive explanations.

Are You Overpaying? Tips for Evaluating Your Insurance Needs

When it comes to managing your finances, one of the biggest concerns can be whether you're overpaying for insurance. Evaluating your insurance needs is essential to ensuring that you’re not just throwing money away. Start by reviewing your current policies and coverage limits. Consider factors such as your lifestyle, the value of your assets, and your potential liabilities. For a comprehensive guide on this subject, check out NerdWallet's Insurance Guide. Additionally, obtaining quotes from multiple insurers can provide perspective on market rates and help identify if you need to adjust your coverage.

Another good practice is to reassess your insurance needs periodically, especially after major life changes like a new job, moving to a new home, or experiencing changes in your family structure. Consider using online tools to calculate your coverage needs. Websites like Insure.com offer calculators to help you determine the amount of coverage that is right for you. Lastly, don’t hesitate to consult with a licensed insurance agent who can assist you in tailoring your policies to your specific situation, ensuring you get the right coverage without overpaying.