Trusted Moving Solutions

Your reliable partner for seamless relocation.

Crypto Regulation Roulette: Spin the Wheel to Know What's Next

Join the crypto regulation game! Spin the wheel and discover what could shape the future of your investments—exciting changes await!

Understanding Global Crypto Regulations: What You Need to Know

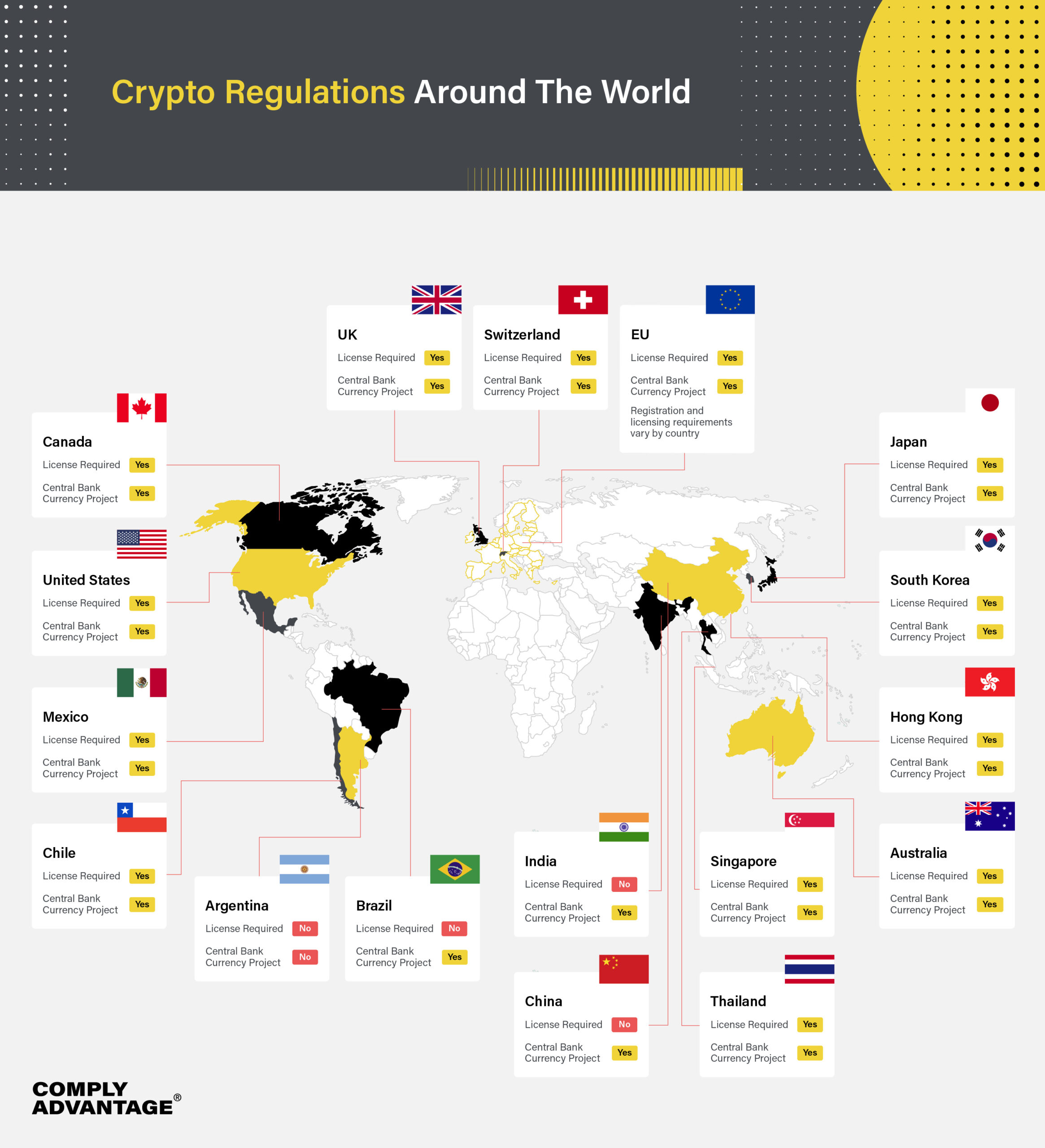

Understanding global crypto regulations is crucial for anyone involved in cryptocurrencies, whether you're an investor, trader, or developer. As the adoption of digital currencies continues to rise, various countries have begun implementing regulations to manage the risks associated with them. This landscape is constantly evolving, with nations like the United States and the European Union leading the charge. Key regulations often center around issues such as anti-money laundering (AML) practices, Know Your Customer (KYC) requirements, and taxation laws, making it vital for individuals and businesses to stay informed.

Furthermore, different regions exhibit varied approaches to cryptocurrency regulation. For instance, Asia is home to some of the most progressive regulations, with countries like Japan recognizing cryptocurrencies as legal tender, while others, like China, impose strict bans. To navigate this complicated scenario, it's important to regularly consult resources like government websites and legal advisories. By being proactive about understanding these regulations, you can ensure compliance and mitigate potential legal risks as you engage in the crypto market.

Counter-Strike is a highly competitive first-person shooter game that pits two teams against each other: the Terrorists and the Counter-Terrorists. Players engage in various objective-based game modes, such as bomb defusal and hostage rescue. If you're looking to enhance your gaming experience, you might want to check out the betpanda promo code for some exciting bonuses. The series has a rich history and has evolved through numerous iterations, solidifying its status in the esports arena.

The Future of Cryptocurrency: How Changing Laws Impact Your Investments

The landscape of cryptocurrency is rapidly evolving, influenced significantly by changing laws and regulations around the world. As governments begin to recognize the long-term potential of digital currencies, they are simultaneously grappling with the necessity of establishing regulatory frameworks to protect investors and ensure market stability. For instance, countries like the United States and the European Union are working on comprehensive legislation that could shape the future of cryptocurrency investments. These legal changes could mean stricter compliance requirements for exchanges and ICOs, impacting how investors participate in the market.

Furthermore, the impact of changing laws on cryptocurrency could lead to increased mainstream adoption. As institutional investors start to engage more with digital assets, the demand for a clearer regulatory environment will become paramount. A more defined legal framework can enhance investor confidence, potentially driving prices upward as more participants enter the market. In conclusion, staying informed about legislative trends is essential for investors looking to navigate the complexities of the cryptocurrency market successfully.

Will Your Crypto Wallet Survive the Next Regulatory Shift?

As governments around the world continue to grapple with the challenge of regulating cryptocurrencies, one pressing question emerges: Will your crypto wallet survive the next regulatory shift? The evolving landscape of digital currencies demands that crypto investors remain vigilant. Each regulatory change can have far-reaching implications, affecting the security, accessibility, and legality of your assets. For instance, stricter regulations may lead to increased compliance costs for wallet providers, which could impact the services they offer or even lead to the shutdown of less compliant platforms. Consequently, it's vital to stay informed about potential regulatory developments.

To ensure your crypto wallet not only survives but thrives in a regulatory environment, consider the following strategies:

- Choose reputable wallet providers who prioritize compliance and security.

- Stay updated on local and international cryptocurrency regulations to be prepared for changes.

- Diversify your holdings across different wallets and cryptocurrencies to minimize risk.