Trusted Moving Solutions

Your reliable partner for seamless relocation.

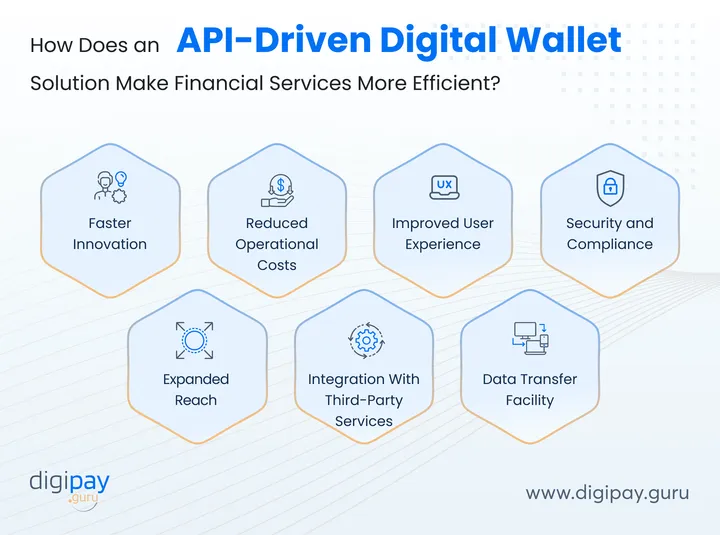

Going Cashless: How Digital Wallet Integrations Are Changing the Game

Discover how digital wallet integrations are revolutionizing payments! Join the cashless revolution and stay ahead of the game.

The Rise of Digital Wallets: How They're Transforming Everyday Transactions

The rise of digital wallets has revolutionized the way we handle everyday transactions. With the advent of smartphones and secure payment technologies, consumers are increasingly opting for contactless payment solutions that offer convenience and speed. Modern digital wallets such as Apple Pay, Google Pay, and PayPal allow users to store their credit and debit card information securely, making it easier than ever to make purchases without the need for cash or physical cards. This transition not only enhances the shopping experience but also promotes a more efficient and streamlined approach to managing finances.

Moreover, digital wallets are transforming the business landscape by enabling merchants to accept a variety of payment methods seamlessly. As more customers adopt these innovative solutions, businesses are recognizing the necessity of integrating digital wallet options into their payment systems to remain competitive. In fact, studies show that companies that embrace digital payment technologies can boost sales and improve customer satisfaction. As we move further into a cashless society, it's evident that digital wallets are not just a trend; they are a foundational element of our financial ecosystem.

Counter-Strike is a highly popular tactical first-person shooter game that has captivated players around the world. Its competitive nature and strategic gameplay require teamwork and skill to succeed. For those interested in enhancing their gaming experience, they can check out the betpanda promo code for some exciting offers.

5 Key Benefits of Embracing Cashless Payments for Your Business

In today's fast-paced digital economy, embracing cashless payments can provide businesses with numerous advantages. One of the primary benefits is enhanced customer convenience. Cashless transactions allow customers to pay quickly using credit cards, mobile wallets, or online payment platforms, minimizing wait times and streamlining the purchasing process. This ease of payment not only improves customer satisfaction but also encourages repeat business as consumers appreciate seamless shopping experiences.

Another key benefit is improved financial tracking. With cashless payments, every transaction is recorded electronically, enabling businesses to easily monitor sales, track expenses, and analyze customer behavior. This data-driven approach allows for better decision-making and can help in tailoring marketing strategies to meet customers' needs. Additionally, by reducing the handling of cash, businesses can enhance security and mitigate the risks associated with theft and fraud.

Is Your Business Ready for a Cashless Future? Here's What You Need to Know

As the world increasingly moves towards digital transactions, it's crucial for businesses to assess whether they are ready for a cashless future. With consumers becoming more comfortable using mobile wallets, contactless payments, and cryptocurrency, businesses must adapt to these changes to stay competitive. To evaluate your readiness, consider implementing the following strategies:

- Adopt relevant payment technologies.

- Train staff on digital transaction processes.

- Ensure robust cybersecurity measures are in place.

The transition to a cashless economy offers numerous benefits, such as improved transaction speed and efficiency, as well as enhanced tracking of financial data. However, it also presents challenges, including the need for consistent internet access and the issue of digital fraud. Businesses must stay ahead of these challenges by investing in education and technological upgrades. Remember that being proactive in preparing for a cashless future can not only streamline your operations but also attract a tech-savvy customer base that values convenience.